Case Study

The road to Cigar Lake production

When one of Cameco’s most prized uranium assets flooded not once but twice, the company faced heaps of scrutiny from investors, regulators and the industry at large.

Investor perception studies showed Cameco’s reputation had taken a significant hit. Questions mounted on its operational difficulties and ability to bring the esteemed asset into production.

Recovering from those floods was an enormous challenge, so the company needed to do things the right way.

“We realized we were in a very tough spot and the spotlight was really on us,” recalled Rachelle Girard, director, investor relations. “We knew we had to be very transparent on this issue and keep stakeholders fully informed of what we were doing.”

So Cameco committed to communicating early and often with the investment community. That meant providing not only standard updates in its quarterly reports, but going beyond that to issue updates even when there wasn’t much information to share.

“We quickly learned that a lack of frequent and detailed communication could result in the circulation of inaccurate information among the investment community and have a significant impact on our share price,” said Rachelle. “So we kept the investment community at an operational level in terms of the information we provided.”

Regulators also needed firm assurance that Cameco was taking the right approach to bring the mine into production. Cigar Lake adopted a mantra called “Assurance of Success” which essentially meant planning for every possible outcome to ensure all risks were mitigated.

“At times we wondered if we were being too cautious, but it was the right approach to show regulators that our re-entry plan was sound and we were managing risk to lowest level possible,” said Scott Bishop, chief mine engineer at Cigar from 2004 to 2010.

“We assumed the worst and that level of detail that went into our planning carried over into the mine design. The cost was too big to not get it right.”

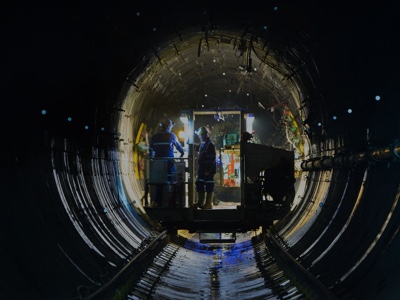

Construction got back on track in 2010 and investors got the opportunity to ask questions about progress and learn about the challenges throughout. Cameco even organized an investor/media event which opened up the underground workings to a tour (an uncommon, increased level of visibility which helped cement Cameco’s road to recovery).

And when the first truckload of ore finally left the mine for the McClean Lake mill in March 2014, Cameco had come a long way to repair its reputation. Over the past few years Rachelle noted that operational issues have gone from being among the top three weakness in investors’ eyes to near the bottom of the list of concerns. Production is now going strong and the mine is aiming to ramp up to full production in 2017.

While more difficulties could arise in Cigar Lake’s incredibly tricky mining backdrop of the Athabasca Basin, Cameco is in good standing with its key stakeholders and ready to manage whatever may come.

“It’s a big deal for us, especially in the current weak market, because we have a lot of large shareholders that are willing to be patient because they do see that reliability in our operations,” said Rachelle.

“They have seen how we’ve prevailed through some very challenging situations and our commitment to full transparency and open communication has made a difference.”