Inkai

- Inkai is owned 40% by Cameco and 60% by Kazatomprom, which is majority-owned by the Kazakh government.

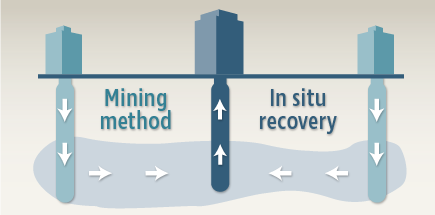

- Tapping into the vast uranium potential of Kazakhstan, Joint Venture Inkai LLP operates the in situ recovery mine.

- The ISO 14001 and BSI OHSAS 18001 certified facility follows western standards for worker safety and environmental protection since it began operations in 2008.

Production

2024 Q4 Update

- Production

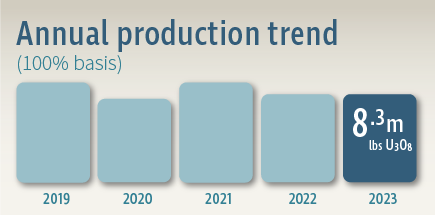

Production was impacted by the continued procurement and supply chain issues in Kazakhstan, most notably, related to the stability of sulfuric acid deliveries. As a result, total 2024 production from JV Inkai on a 100% basis was 7.8 million pounds (3.6 million pounds our share), 0.6 million pounds lower than in 2023. Production was impacted by differences in the annual mine plan, a shift in the acidification schedule for new wellfields, and unstable acid supply throughout the year.

We received 2.7 million pounds of our total share of Inkai’s 2024 production. The remainder of our share of 2024 production, about 0.9 million pounds, is being stored at JV Inkai for future delivery in order to optimize transportation and delivery costs. The timing of future deliveries is uncertain.

- Production purchase entitlements

Under the terms of a restructuring agreement signed with our partner KAP in 2016, our ownership interest in JV Inkai is 40% and KAP’s share is 60%. However, during production ramp-up to the licensed limit of 10.4 million pounds, we are entitled to purchase 57.5% of the first 5.2 million pounds of annual production, and as annual production increases over 5.2 million pounds, we are entitled to purchase 22.5% of such incremental production, to the maximum annual share of 4.2 million pounds. Once the ramp-up to 10.4 million pounds annually is complete, we will be entitled to purchase 40% of such annual production, matching our ownership interest.

Based on the production purchase entitlement under the 2016 JV Inkai restructuring agreement, for 2024 we were entitled to purchase 3.6 million pounds, or 45.9% of JV Inkai’s 2024 production of 7.8 million pounds. Timing of our JV Inkai purchases will fluctuate during the quarters and may not match production, and similar to 2023, the 2024 timing was impacted by shipping delays. Total purchases in 2024 were 4.2 million pounds, of which 2.5 million pounds were related to our 2024 entitlement.

- Cash distribution

Excess cash, net of working capital requirements, will be distributed to the partners as dividends. In 2024, we received a cash dividend from JV Inkai of $129 million (US), net of withholdings. Our share of dividends follows our production purchase entitlements as described above. Delays in deliveries of our share of production could reduce the dividend that JV Inkai is able to declare for the calendar year.

- Updated Inkai Technical Report

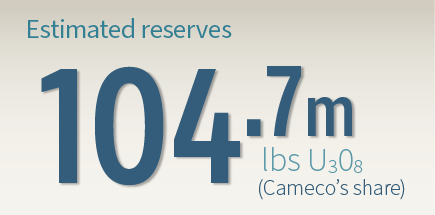

A new NI 43-101 technical report for Inkai Operation was filed November 12, 2024, replacing the previous Inkai Operation technical report, filed in January of 2018. Key highlights of the report include:

- increase in average price used in the economic analysis to $87.50 per pound U3O8 from $54.40 (US)

- increase in estimated average cash operating costs per pound to $12.66 from $9.55

- expected total packed production of 213.3 million pounds U3O8 based on mineral reserves from 2024 through the projected mine life extending to mid-2045

- decrease in estimated after-tax internal rate of return of 26.9%, using the total capital investments, along with the operating and capital cost estimates, from 27.1%

- total estimated Inkai capital to bring the remaining mineral reserves into production is approximately $1.5 billion, an increase of 106% when compared to the 2018 Technical Report’s 2024 to mid-2045 time frame. The change is mostly related to wellfield development activities with increased drilling tariffs and higher costs for sulfuric acid and other materials.

Planning for the Future

- Expansion project

Engineering work for a process expansion of the Inkai circuit to support a nominal production of at least 10.4 million pounds U3O8 per year has been completed and construction is in progress. The expansion project includes an upgrade to the yellowcake filtration and packaging units, and the addition of a pre-dryer and calciner. Please refer to Section 17.4 of the updated Technical Report for further details. Currently, Inkai estimates the completion of the expansion project in 2025, subject to it successfully managing the schedule risk related to contractor performance.

- Production

On December 31, 2024, we were unexpectedly informed that Kazatomprom, as majority owner and controlling partner of the joint venture, had directed JV Inkai to suspend production activity as of January 1, 2025. The suspension was implemented pending approval by Kazakhstan’s Ministry of Energy of an extension to submit an updated Project for Uranium Deposit Development documentation. When the extension had not yet been granted at 2024 year-end as expected, Kazatomprom made the decision to halt production in order to avoid potential violation of Kazakhstan legislation. The extension was approved and JV Inkai resumed production on January 23, 2025. Cameco and Kazatomprom continue to work with JV Inkai to determine the impact of the approximately three-week production suspension on the operation’s 2025 production plans.

Our share of production is purchased at a discount to the spot price and included at this value in inventory. In addition, JV Inkai capital is not included in our outlook for capital expenditures.

- Mineral extraction tax

In July 2024, the government of the Republic of Kazakhstan introduced amendments to the country’s Tax Code which involves changes to the Mineral Extraction Tax (MET) rate for uranium. The MET rate will increase from the current rate of 6%, to a rate of 9% in 2025, with a further change in 2026 that will see the introduction of a progressive MET system based on actual annual production volumes under each subsoil use agreement. Under the progressive system that will take effect in 2026, the highest rate is 18% for operations producing over 10.4 million pounds. Additionally, a further MET of up to 2.5% based on the spot market price of uranium, will also be introduced in 2026. The MET is incurred and paid by the mining entities, which is expected to have a significant impact on JV Inkai’s cost structure.

Environment & Safety

Worker safety, environmental monitoring and proper decommissioning after project completion are of the utmost importance to Cameco.

Reserves & Resources

Our mineral reserves and resources are the foundation of our company and fundamental to our success.

Caution about Forward-Looking Information

This page may contain forward-looking information that is based upon the assumptions and subject to the material risks discussed on page 2 of Cameco's most recent Quarterly MD&A.